7 Simple Techniques For Affordable Care Act Aca In Toccoa Ga

Wiki Article

The Ultimate Guide To Home Owners Insurance In Toccoa Ga

Table of ContentsThe Facts About Medicare Medicaid In Toccoa Ga RevealedSome Ideas on Insurance In Toccoa Ga You Need To KnowThe smart Trick of Affordable Care Act Aca In Toccoa Ga That Nobody is Talking AboutThe 6-Second Trick For Automobile Insurance In Toccoa Ga

A monetary consultant can likewise assist you make a decision exactly how finest to achieve goals like saving for your youngster's college education and learning or settling your financial obligation. Economic advisors are not as fluent in tax obligation law as an accountant could be, they can provide some guidance in the tax obligation preparation process.Some financial advisors supply estate planning solutions to their clients. They may be educated in estate preparation, or they might want to function with your estate attorney to address inquiries regarding life insurance policy, counts on and what need to be finished with your investments after you pass away. It's essential for monetary experts to remain up to date with the market, financial conditions and advisory best methods.

To offer investment items, experts need to pass the pertinent Financial Market Regulatory Authority-administered tests such as the SIE or Series 6 examinations to get their qualification. Advisors that wish to offer annuities or various other insurance policy products should have a state insurance coverage license in the state in which they intend to offer them.

Annuities In Toccoa Ga for Beginners

As an example, allow's state you have $5 million in properties to handle. You hire an expert who charges you 0. 50% of AUM per year to help you. This suggests that the consultant will certainly get $25,000 a year in costs for managing your financial investments. As a result of the regular fee structure, many consultants will certainly not deal with customers who have under $1 million in assets to be taken care of.Investors with smaller portfolios might choose an economic expert who bills a per hour fee instead of a portion of AUM. Per hour costs for consultants typically run between $200 and $400 an hour. The more complicated your economic scenario is, the more time your advisor will have to devote to managing your assets, making it much more expensive.

Advisors are competent professionals that can aid you develop a strategy for monetary success and apply it. You could likewise take into consideration reaching out to a consultant if your personal financial circumstances have just recently ended up being more complex. This could imply purchasing a home, marrying, having youngsters or getting a big inheritance.

The 8-Minute Rule for Commercial Insurance In Toccoa Ga

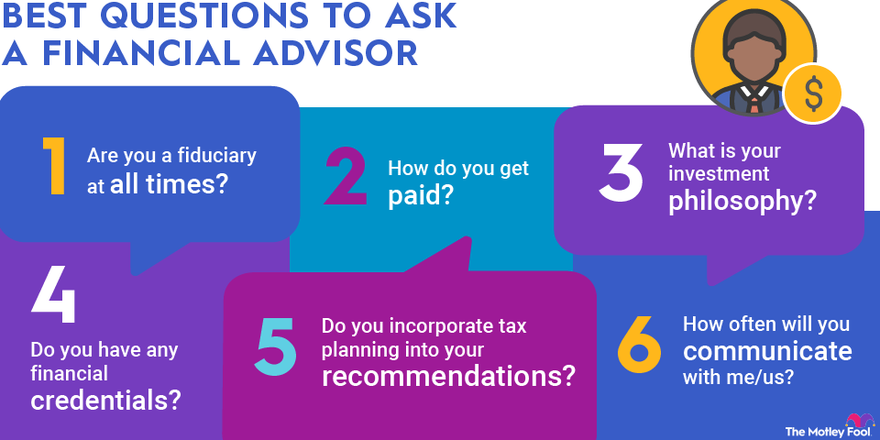

Before you fulfill with the consultant for an initial assessment, consider what services are crucial to you. Older adults may need assist with retired life preparation, while more youthful grownups (Life Insurance in Toccoa, GA) may be trying to find the finest method to invest an inheritance or starting a business. You'll intend to seek a consultant who has experience with the solutions you desire.What company were you in before you got right into financial advising? Will I be functioning with you straight or with an associate advisor? You might additionally want to look at some sample economic plans from the expert.

If all the samples you're supplied are the exact same or similar, it may be an indication that this consultant does not appropriately personalize their advice for every client. There are 3 main sorts of monetary advising professionals: Certified Economic Planner experts, Discover More Here Chartered Financial Experts and Personal Financial Specialists - https://lwccareers.lindsey.edu/profiles/3840718-jim-thomas. The Qualified Financial Planner professional (CFP expert) qualification shows that an expert has met an expert and honest criterion established by the CFP Board

Home Owners Insurance In Toccoa Ga Things To Know Before You Buy

When picking a monetary consultant, consider somebody with a professional credential like a CFP or CFA - https://www.intensedebate.com/profiles/jstinsurance1. You could additionally consider an advisor that has experience in the solutions that are most vital to youThese consultants are typically filled with disputes of rate of interest they're much more salesmen than consultants. That's why it's vital that you have an advisor that functions only in your ideal rate of interest. If you're searching for an advisor who can absolutely supply real value to you, it's crucial to research a variety of potential choices, not merely select the initial name that promotes to you.

Presently, numerous consultants have to act in your "finest passion," but what that involves can be virtually unenforceable, other than in the most outright cases. You'll need to locate an actual fiduciary.

"They should show it to you by showing they have taken major continuous training in retired life tax obligation and estate planning," he states. "You ought to not invest with any kind of advisor who does not spend in their education.

Report this wiki page